Key Takeaways

-

Turkey Drops Tax Plans: Turkey has abandoned plans to tax stock and cryptocurrency gains, focusing instead on narrowing tax exemptions, according to Vice President Fuat Oktay.

-

OpenAI Restructures: OpenAI is transferring control from its nonprofit board to attract investors, with plans for a $6.5 billion capital infusion valuing the company at $150 billion.

-

Mortgage Rates Fall: US mortgage rates have dropped for the third consecutive week, with 30-year fixed-rate mortgages averaging 6.08%.

-

Pakistan Receives IMF Loan: Pakistan has received final approval for a $7 billion IMF loan program, with an immediate disbursement of $1.1 billion.

-

Hezbollah Leader Killed: Israel confirmed the death of Hezbollah leader Hassan Nasrallah following a targeted airstrike on the group’s Beirut headquarters.

Key Market Movement

IPO’s in the week

-

BioAge Labs, Inc. (Nasdaq: BIOA), a clinical-stage biopharmaceutical company, announced the pricing of its initial public offering (IPO) of 10,500,000 shares at $18.00 per share on 26, September, 2024. The shares are listed on the Nasdaq exchange under the ticker symbol “BIOA”. Founded in 2015 and headquartered in Richmond, California, BioAge Labs focuses on developing innovative therapies for aging-related diseases.

-

BKV Corporation (NYSE: BKV), a US-based energy company, announced its IPO of 15,000,000 shares at $18.00 per share on 26, September, 2024. The shares trade on the NYSE under “BKV”. BKV provides natural gas production, gathering, processing, and transportation services nationwide. For more information, contact Investor Relations or access the SEC filing online.

-

Guardian Pharmacy Services, Inc. (NYSE: GRDN), a US-based pharmacy service company, announced its IPO of 6,750,000 shares at $14.00 per share. The shares will trade on the NYSE under “GRDN” starting September 26, 2024. Guardian Pharmacy serves long-term care facilities with technology-enabled solutions, including its Guardian Compass and GuardianShield Programs. Founded in 2003, the company is headquartered in Atlanta, Georgia.

-

Legacy Education Alliance, Inc. (NYSE: LGCY), a provider of educational training on personal finance and investing, announced its IPO of 2,000,000 shares at $4.00 per share. The shares will trade on the NYSE under “LGCY” starting September 26, 2024. Legacy Education offers programs through workshops, mentoring, coaching, and e-learning, operating under the Building Wealth with Legacy brand. Founded in 1996, the company is headquartered in New City, New York.

-

Premium Catering (Holdings) Limited (Nasdaq: PC), a Singapore-based certified Halal food caterer specializing in Indian, Bangladeshi, and Chinese cuisine, announced its initial public offering (IPO) of 2,000,000 shares at $4.75 per share, commencing trading on September 25, 2024. With over 11 years of experience, Premium Catering serves foreign construction workers, operates food stalls, provides buffet catering and delivery services, and offers innovative smart incubators for secure, hygienic, and contactless meal delivery. The company’s shares will trade on Nasdaq under the ticker symbol “PC”, marking a significant milestone in its growth journey.

-

Innovation Beverage Group Limited (NASDAQ: IBG) launched its IPO on Sept. 26, 2024, offering 1,350,000 shares at $4.00 each, raising $5,400,000. The global beverage company develops and exports various alcoholic and non-alcoholic brands worldwide.

Markets this week

-

Turkey has abandoned plans to impose taxes on gains from stock and cryptocurrency markets, according to Vice President Fuat Oktay Yilmaz. Instead, the government will focus on narrowing tax exemptions, Yilmaz stated, ruling out a new tax package for this year.

-

OpenAI is restructuring to transfer control from its nonprofit board in a bid to attract investors, with plans for a $6.5 billion capital infusion that would value the company at approximately $150 billion.

-

Mortgage rates have fallen for the third straight week, with the 30-year fixed-rate mortgage averaging 6.08%. While refinancing activity is rising, buyers are taking their time before making decisions.

-

Oil prices steadied after a sharp decline, with Brent crude trading near $72 a barrel and West Texas Intermediate falling below $68, as the market faces pressure from increased supply prospects.

-

Fidelity reduced mobile deposit limits from $100,000 to $1,000 after a check fraud scheme targeted its cash management accounts. Fraudsters used social media to deposit fake checks and withdraw funds quickly. Retirement accounts remain unaffected.

-

China’s stock markets faced trading delays as a surge in orders from new stimulus measures overwhelmed the Shanghai Stock Exchange. Turnover hit 710 billion yuan in the first hour, briefly stalling the Shanghai Composite Index before it resumed gains. Trading volumes neared 1 trillion yuan, marking the busiest period.

-

Several quantitative hedge funds in China faced significant losses as the stock market recorded its largest rally in years, driven by new economic stimulus measures. These funds were caught off guard after shorting index futures through Direct Market Access (DMA) strategies, leading to unexpected financial repercussions.

Treasuries Rally as Fed Rate-Cut Bets Hold Steady

-

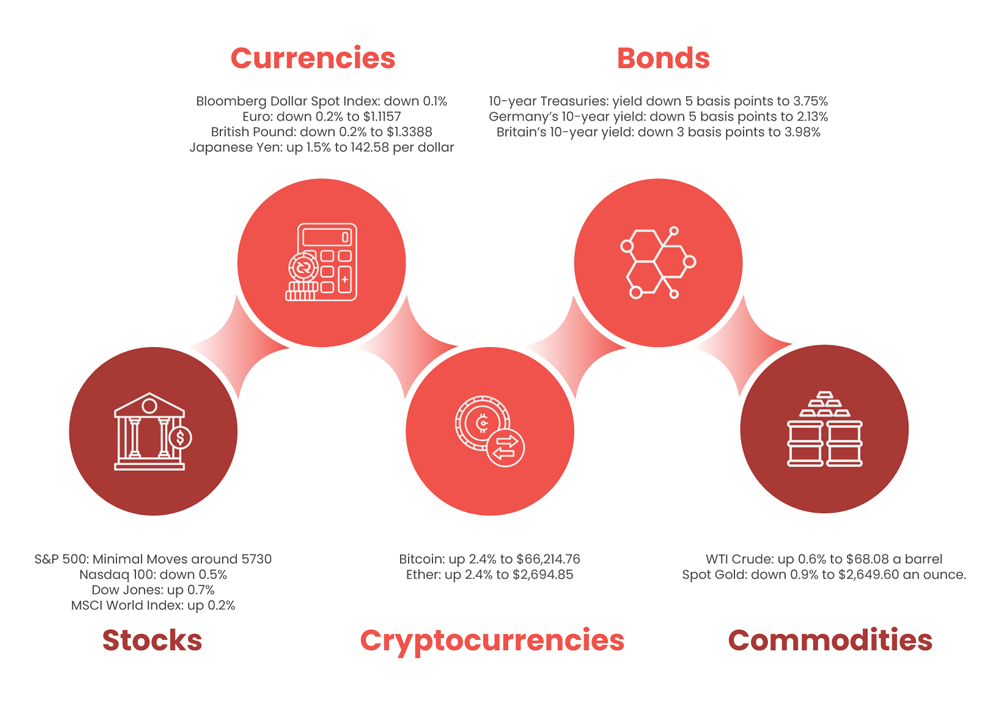

Treasuries rallied while U.S. stocks fluctuated, with inflation data not altering expectations for the Federal Reserve’s rate cuts. The S&P 500 was stable, the Nasdaq 100 dipped 0.5% due to Nvidia’s performance, and the 10-year Treasury yield fell to around 3.75%.

-

The Fed’s preferred inflation gauge rose modestly in August, reinforcing predictions of continued rate cuts. Consumer sentiment reached a five-month high, indicating a resilient economy. Markets are pricing a split chance between a quarter-point and half-point rate cut at the next Fed meeting.

-

China’s stimulus announcements boosted risk appetite, and the CSI 300 Index marked its best week since 2008.

Politics Weekly

-

Shigeru Ishiba was elected as Japan’s next prime minister after winning the leadership of the ruling Liberal Democratic Party. A former defense minister, Ishiba advocates for stronger regional security, including the creation of an “Asian NATO”.

-

Malaysian Prime Minister Anwar Ibrahim is facing criticism for allegedly using the anti-corruption agency to target political rivals, including former Prime Minister Mahathir Mohamad, raising concerns about political retaliation.

-

Israeli Prime Minister Benjamin Netanyahu pledged to continue military strikes against Hezbollah in Lebanon until key objectives are met, including the safe return of northern Israeli residents.

-

Israeli forces have conducted airstrikes against Hezbollah targets in Lebanon for four consecutive days, resulting in over 600 casualties, according to Lebanon’s health ministry.

-

Netanyahu’s far-right allies, National Security Minister Itamar Ben Gvir, threatened to quit the ruling coalition if a permanent truce is reached in Lebanon.

-

Hezbollah has launched hundreds of rockets at northern Israel, including its first attempt to strike Tel Aviv, marking the worst escalation in violence between the two sides since the 2006 war.

-

Pakistan has received final approval for a $7 billion loan program from the International Monetary Fund (IMF), with an immediate disbursement of $1.1 billion.

-

The Pentagon confirmed that a Chinese nuclear-powered submarine sank earlier this year at a shipyard in Wuhan, with uncertainty about whether it was carrying nuclear fuel.

-

Ukrainian President Volodymyr Zelensky met with U.S. leaders, including President Biden, seeking approval for the use of long-range missiles against Russia. He aimed to secure continued bipartisan support, particularly from Republicans, ahead of the November elections.

-

Former Maryland Governor Larry Hogan, a centrist Republican, is running for the Senate, rejecting Trump’s endorsement. Despite his popularity, Democrats warn voters of the national implications of a Republican win in the deep-blue state.Vice President Kamala Harris is visiting the U.S.-Mexico border in Arizona to promote a tougher immigration stance, addressing Republican attacks on her previous liberal views. She is currently trailing Donald Trump in voter support on this issue.

-

Israel has confirmed the death of Hezbollah leader Hassan Nasrallah following a targeted airstrike on the group’s headquarters in Beirut. The strike, part of the heaviest assault on Lebanon’s capital in nearly 20 years, hit a command center concealed beneath residential buildings.

-

The Israeli military announced a large-scale airstrike targeting military infrastructure in Yemen, focusing on power plants and a sea port used by the Houthi regime to import oil. The operation, involving fighter jets and intelligence planes, hit sites in Ras Isa and Hudaydah.

Technology Advancements this week

-

US President Joe Biden and Indian Prime Minister Narendra Modi announced plans to build a semiconductor plant in India, producing infrared, gallium nitride, and silicon-carbide chips. This strategic partnership, revealed during Modi’s Quad summit visit, aims to boost India’s manufacturing sector, create jobs, and secure semiconductor supply chains, strengthening US-India cooperation in critical technologies.

-

HSBC is set to join the burgeoning AI infrastructure finance market, according to Gerry Keefe, who revealed the bank’s plans in a Bloomberg TV interview. This move comes as industry giants BlackRock and Microsoft aim to raise $30 billion in private equity for AI initiatives, signaling a significant surge in investment in the sector.

-

Telegram to Share More User Data with Governments: CEO Durov. Telegram will comply with government requests for user data, CEO Pavel Durov announced, as he faces charges in France tied to illegal activities on the app.

-

The House passed a bill limiting NEPA reviews for Intel and TSMC projects, sending it to President Biden for signature. The bill aims to accelerate domestic semiconductor production and reduce US dependence on Asia.

-

Grammarly Names New CFO, CTO Ahead of Potential IPO. Grammarly appoints Mark Schaaf (ex-Instacart) as CTO and Navam Welihinda (ex-HashiCorp) as CFO, bolstering its leadership team with IPO-experienced executives.

-

OpenAI has officially launched its voice assistant feature to all paid ChatGPT users, following a temporary delay to address potential safety concerns.

-

The FBI has raided the Virginia offices of Carahsoft, a leading IT distributor to the US government, as part of an undisclosed investigation.

-

Google is facing two separate antitrust challenges from the US Department of Justice, and according to CEO Sundar Pichai, the legal battles are expected to extend for several years.

Don’t miss out on next week’s market insights and updates!

👉Keep the conversation going! Subscribe to our weekly newsletter for more insights, delivered straight to your inbox.