Analyst Highlights

- U.S. equities closed the holiday-shortened week lower across major indices, while the CBOE (VIX) ticked higher, reflecting modest volatility pickup.

- Crypto markets posted broad gains on a 7-day basis, with altcoins outperforming as year-end liquidity amplified moves despite range-bound price action.

- Commodities were mixed: oil softened modestly, while gold and silver held steady as traders positioned for upcoming commodity index rebalancing.

- Rates & credit: Anna Paulson signaled potential additional rate cuts later in 2026, while AI capex and private credit growth fueled record corporate bond trading volumes.

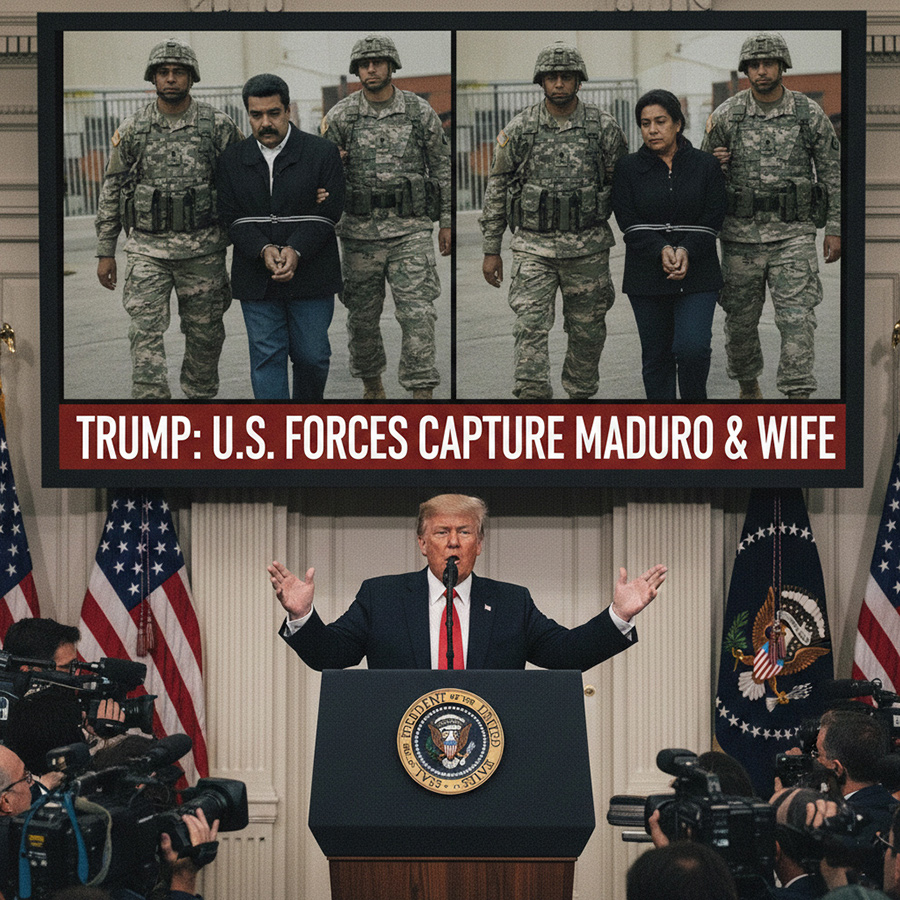

- Geopolitics: Donald Trump said the U.S. would temporarily run Venezuela post-Maduro, drawing condemnation from China and adding to Middle East and Asia-Pacific tensions.

- Technology & supply chains: AI-driven infrastructure investment accelerated globally, from North American data centers to India’s $4.6B electronics push, underscoring long-term capex intensity.

IPO’s in the week

- No IPOs were priced during the final holiday-shortened week of 2025 as issuers deferred launches to January amid low liquidity and reduced institutional participation.

Markets Weekly

- S&P 500 closed at 6,858.47, down 47.27 points (-0.68%) for the week.

- Russell 1000 ETF closed at 374.33, down 2.42 points (-0.64%) for the week.

- Russell 2000 closed at 2,508.22, down 11.58 points (-0.46%) for the week.

- Russell 3000 closed at 3,894.32, down 24.94 points (-0.64%) for the week.

- CBOE (VIX) closed at 14.51, up 0.31 points (+2.18%) for the week.

- Dow Jones closed at 48,382.39, down 79.54 points (-0.16%) for the week.

- NASDAQ closed at 23,235.63, down 238.72 points (-1.02%) for the week.

- Bitcoin closed at 90,914.73, up 3,776.59 points (+4.33%) for the week.

- Ethereum closed at 3,126.98, up 192.44 points (+6.56%) for the week.

- Solana closed at 133.29, up 10.16 points (+8.25%) for the week.

- XRP closed at 2.0777, up 0.23 points (+12.45%) for the week.

- Gold closed at 4,329.60, up 4.50 points (+0.10%) for the week.

- Silver closed at 71.015, up 1.16 points (+1.66%) for the week.

- WTI crude closed at 57.32, down 0.76 points (-1.31%) for the week.

- Brent crude closed at 60.75, down 1.19 points (-1.92%) for the week.

- Oil prices held steady despite Venezuela turmoil, as global supply swelled and analysts flagged rebuilding output as a distant, uncertain prospect.

- Gold and silver held steady early in 2026 as traders braced for commodity index rebalancing that could pressure prices short term.

- S. stocks edged higher in a volatile start to 2026 as investors weighed stretched valuations, rising Treasury yields, and heavy AI positioning.

- Wall Street entered 2026 with elevated expectations after a rare cross-asset rally in 2025, leaving markets priced for continued growth.

- Bitcoin’s rebound attempt stalled near $90,000, staying range-bound as thin year-end liquidity amplified moves and traders avoided short-dated signals.

- Philadelphia Fed President Anna Paulson said additional rate cuts may be appropriate later in 2026 if inflation cools and growth remains benign.

- AI infrastructure funding and private credit growth are boosting corporate-bond trading, with about $50 billion in daily volume and record issuance expected

Politics Weekly

- Trump said U.S. forces captured Venezuela’s Nicolás Maduro and his wife after strikes hit Caracas; the pair face U.S. drug trafficking charges.

- Trump said the U.S. would temporarily run Venezuela after Maduro, deploy oil firms, and keep forces on alert pending a political transition.

- China condemned U.S. strikes and Maduro’s capture as “hegemonic,” urging Washington to follow international law and the UN Charter.

- Donald Trump said the U.S. could support Iranian protesters if repression escalates, prompting Tehran to warn U.S. forces against interference.

- Ali Khamenei said protest grievances were valid but blamed foreign incitement, vowing a crackdown as unrest continued across Iran.

- Saudi-led forces hit UAE-backed separatists in Yemen with airstrikes as clashes intensified in Hadramout, highlighting deepening Saudi–UAE rifts.

- The UAE said it will withdraw troops from Yemen after clashes with Saudi-backed forces, deepening fractures between Gulf allies over the conflict.

- Taiwan’s President Lai vowed to strengthen defenses after China conducted its most intrusive military drills, urging swift approval of higher defense spending.

- Russia said a Ukrainian drone strike in occupied Kherson killed at least 24, though the claims could not be independently verified.

- Zelenskiy said U.S. negotiators will join European leaders in Paris to discuss postwar security guarantees and Ukraine’s recovery.

Technology Advancements in the week

- AI-driven demand has fueled about $70B in data-center M&A talks in 2025, highlighting sustained infrastructure investment behind the boom.

- DeepSeek outlined a new AI training method aimed at cutting compute and energy use, as China accelerates efficiency amid chip constraints.

- Swiss-backed firms plan up to €8B in gas-powered data centers in Alberta, highlighting AI-driven infrastructure expansion and energy-security prioritization.

- India approved $4.6B in electronics component investments to localize supply chains, aiming to generate $28.6B in output and reduce reliance on China.

- Trump Media said it will issue a shareholder-distributed cryptocurrency on Cronos via a Crypto.com partnership, allocating one token per share.

- Xreal cut the price of its entry AR glasses to $449 while boosting resolution to 1200p, signaling continued pressure toward mainstream adoption.

👉 Keep the conversation going! Subscribe to our weekly newsletter for more insights, delivered straight to your inbox.